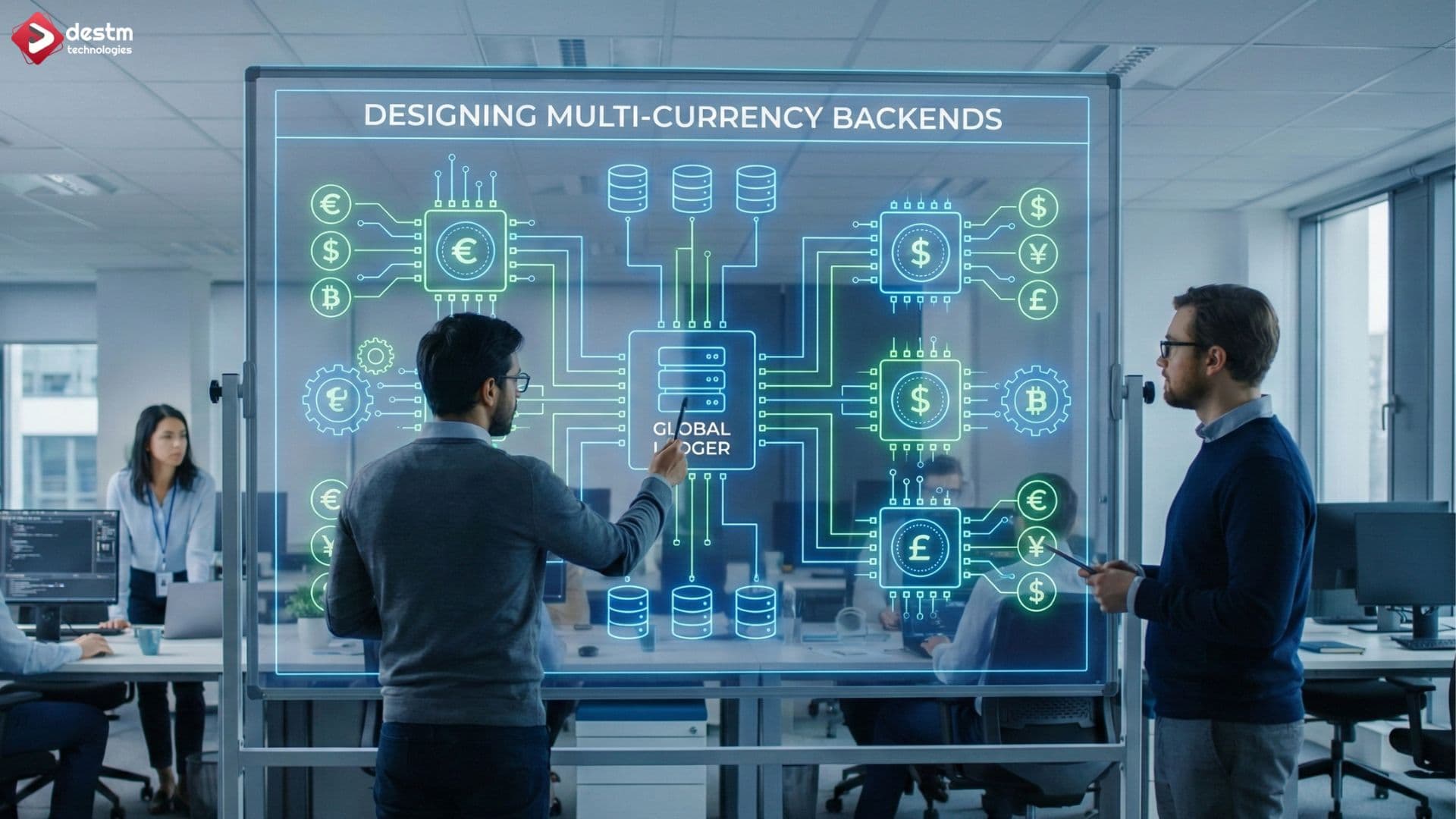

In today’s global e-commerce ecosystem, businesses are no longer confined by geographical boundaries. Customers expect to browse, shop, and pay in their local currencies, and they demand transparency throughout the entire buying process. However, supporting multi-currency operations is more complex than simply converting prices on the frontend. It involves orchestrating accurate FX conversions, managing settlement differences, ensuring regulatory compliance, and maintaining precise accounting across multiple regions.

Designing a robust multi-currency backend requires engineering systems that can handle currency volatility, diverse payment methods, rounding rules, tax variations, and global transaction flows. Without the right architecture, businesses risk inconsistencies, accounting errors, customer dissatisfaction, and operational bottlenecks.

Implementing multi-currency functionality comes with several technical and business complexities:

Data Inconsistencies

Storing financial data across multiple currencies can lead to rounding issues, floating-point errors, and mismatched accounting records. Without a consistent standard like a base currency, inconsistencies accumulate quickly.

Real-Time FX Volatility

Currency exchange rates fluctuate constantly. Systems must ensure consistent pricing while handling live FX updates, cached values, and fallback mechanisms in case FX providers fail.

Payment Gateway Limitations

Not all gateways support all currencies. Some process payments in local currency but settle funds in a different one, causing discrepancies between customer-facing and settlement currencies.

Compliance & Reporting Requirements

Regulations vary widely across regions. Businesses must handle local taxes, regional pricing rules, and accounting standards — all while ensuring accurate, auditable financial records.

High Engineering Complexity

Multi-currency logic touches multiple core systems: pricing engines, checkout flows, ledgers, BI systems, refunds, and payment reconciliation. Poorly designed integrations can create technical debt and operational chaos.

Built with CuberiQ

Real-World Example:

Consider a global marketplace selling across Europe and Asia. A user may pay in GBP, while the payment gateway settles in EUR, and the company’s internal ledger operates in USD. Without a structured multi-currency model, the platform risks financial discrepancies during refunds, reporting, or audits.

Despite the challenges, several proven strategies help build a scalable, accurate multi-currency system:

Base Currency Strategy

Establishing a “base currency” for internal accounting reduces inconsistencies. Customer prices can be shown in their local currency, while all backend calculations and financial reporting flow through a single standardized currency.

Currency Service (API-Driven Architecture)

Modern systems use a central Currency Service that handles:

FX rate ingestion

Conversion accuracy

Rounding rules

Historical rate storage

Regional pricing logic

This service provides unified APIs to catalog, checkout, payment, and reporting systems — reducing duplicate logic.

Data Migration & Data Modeling

Similar to legacy modernization, currency migration requires careful planning. Storing values in minor units (cents, paise) or using decimals prevents precision errors. Phased migration ensures existing financial data aligns with new standards.

Payment Gateway Integration

APIs help bridge customer-facing currencies and gateway-supported ones. Intelligent routing can determine:

Which gateways support the user’s currency

Whether conversion is needed before settlement

FX margin rules applied by processors

This avoids manual reconciliation and financial mismatches.

Cloud-Based Multi-Currency Scaling

Cloud infrastructure simplifies caching FX rates, scaling conversion services, and supporting global storefront traffic. Businesses benefit from:

Automated FX updates

Distributed caching

Resilient failover

Region-based latency optimization

However, compliance and data residency must be considered when dealing with financial information.

Case Study:

A Europe-based retailer integrated a dedicated Currency Service that pulled hourly FX rates from multiple providers. Their checkout system automatically converted prices into local currencies, while their ledger stored transactions in USD. The company later migrated this system to the cloud, improving performance and reducing conversion-related customer disputes by 30%.

E-commerce Marketplace

A major marketplace implemented a multi-currency backend allowing buyers to pay in 50+ currencies. The platform used real-time FX rates with automatic fallbacks, enabling accurate pricing even during provider outages. This increased conversion rates in emerging markets by 18%.

Fintech Payment App

A fintech startup integrated multi-currency wallets, allowing users to hold balances in different currencies. By storing historical FX rates and settlement data, the system ensured fully auditable financial flows, improving compliance and reducing refund disputes.

Global Retailer

A retailer modernized its monolithic pricing engine using microservices. This allowed easy integration with payment gateways, local tax rules, and regional pricing models. The new backend supported rapid expansion into five new countries without reengineering core systems.

Thorough Planning and Data Modeling

Start with identifying base currency, supported currencies, rounding rules, and gateway limitations. Proper modeling prevents costly rework later.

Risk Assessment & Mitigation

Identify risks such as FX provider downtime, conversion mismatches, refund inconsistency, or incorrect rounding. Implement backups, rate snapshots, and deterministic logic for conversions.

Ongoing Monitoring & Maintenance

Even after deployment, FX systems require continuous monitoring for:

Rate discrepancies

Gateway outages

Unexpected settlement behavior

Currency formatting issues

Proactive alerting helps prevent downstream financial inaccuracies.

AI-Driven Pricing & FX Optimization

AI models will predict FX fluctuations and automatically adjust pricing strategies to preserve margins and stabilize conversion rates.

Blockchain-Based Settlements Stablecoins and blockchain ledgers could enable near-instant global settlement, reducing gateway fees and FX losses.

Composable Commerce Architecture Businesses are shifting from monolithic pricing engines to modular, microservice-driven currency systems that can be updated independently.

Cross-Border Compliance Automation Automated tax engines and regulatory compliance services will integrate directly into multi-currency backends, reducing legal and accounting overhead.

Hybrid Currency Models Future platforms will maintain a mix of fixed regional prices, dynamic FX-based prices, and AI-adjusted contextual pricing.

Designing a multi-currency backend is a complex but essential step for businesses aiming to scale globally. At Destm Technologies, we specialize in building scalable, compliant, and high-performance multi-currency architectures tailored for modern commerce. By understanding the challenges, applying strategic design principles, and following industry best practices, organizations can build financial systems that are accurate, resilient, and ready for international growth. As global commerce continues to evolve, staying ahead of emerging trends will ensure that multi-currency systems remain a driver of business expansion rather than an operational burden.

Ready To Transform Your E-commerce Business?

Let's discuss your project and explore how we can help you achieve your goals.